We are going to look at the economic principles that fit into the quadrant bounded on one side by the human spirit and on the other side by order.

Last time we learned the production possibilities technique that has been uniquely developed in the divine economy theory. This is Chapter Four and now we will look at economic principles and use the production possibilities frontier technique to show the relevance of the economic principles.

Chapter Four

Real World Economic Principles

The Leaves of the Divine Economy Model ©

Preface

One of the beauties of the whole system is its reciprocity. Part of the wholesome environment that is sought comes from the health of the system itself. Leaves not only contribute to the growth but they also create a favorable microenvironment and eventually add nutrients back into the system, strengthening the roots. These real world economic principles are numerous like the leaves on a tree and their importance

cannot be forgotten. Each leaf contributes in many ways to the overall health.

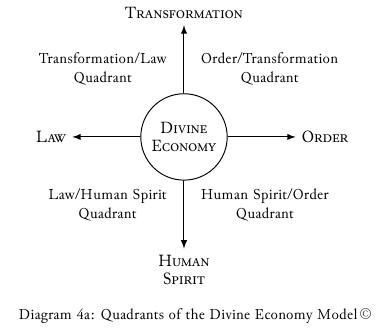

A Canopy Composed of Principles

With the foundation of the conceptual divine economy model laid out and production possibilities frontiers sufficiently examined it now becomes possible to insert economic principles into the model—fully aware of the interconnectedness of all of the principles. The locus of placement of the principles in the model is arbitrary yet it is logical. The logic of placement into the model can be deemed as a mental exercise, forcing one to examine just how interconnected the economic principles are. I take the liberty to begin the process. To begin I divide the model into quadrants with a fundamental element on either side of each quadrant. Dividing the model into quadrants then sets the stage for examination of economic principles

that have a strong tendency towards the following characteristics:

A. human spirit / order

B. order / transformation

C. transformation / law

D. law / human spirit.

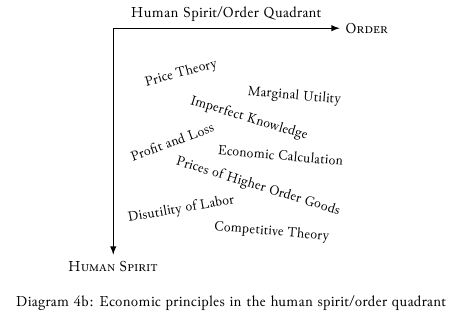

Real World Economic Principles in the HUMAN SPIRIT / ORDER Quadrant

I have chosen eight economic principles for placement in this quadrant. These are principles that exist in, emerge from, and complement both the human spirit and the social order. They find origin from human action and yet they also inspire more human action. They find expression in the market and are amplified in the market and at the same time they continuously emanate knowledge via the market. See Diagram 4b.

Economic Principles

Price Theory

With regards price theory, a good starting point is the law of supply and demand. Accordingly, if the supply of a good or service increases, then the price decreases. Likewise if the demand for a good or service decreases, then the price decreases.

The price of a good or service in the real world is relative. It is relative to other goods and services and it is relative to the earlier price of that good or service itself which means that the system can be described as a floating price system. In other words, all prices are relative at the time and place of human action in the market. It is exactly that fact, that prices are relative to all others, that enables the price system to play an economizing role in decision-making.

Let us assume that you go to a marketplace with $100, needing food and clothing and medicine but you find the market in a dysfunctional state—there are no relative prices. Only one price, $45 for the clothing, is known at the time. Would you know how to prioritize, or whether to buy the clothing or not? A price system absent of relative prices strips the market process of its ability to function.

And now we have come to the point where there is a need to define the market to offset the commonly held prejudices against the market. The market is universal. It is a process where knowledge flows freely. The market is benevolent and its process is profoundly cooperative, and

quietly consultative in nature.

The market is a conveyor of information just as is language. The following analogy is useful. Individually I can speak to myself alone or I can more fully use language and speak with others. Undoubtedly the full benefits of language as a human endowment come from its social nature. If I happen to speak vulgarly, language as a human institution should not be attacked as being harmful. In fact, the social nature of language empowers it to have a moderating and refining influence on individuals, thereby lessening the occurrence of vulgarity. The market, likewise, releases the full benefits of the human spirit and all of the associated resources. If someone acts in a crude or frivolous manner it is not the fault of the market. In fact it is the social nature of the market that will tend to moderate and refine individuals, ultimately facilitating the advancement of civilization.

The price system finds expression in the market in the form of relative prices which convey important information. For instance, factors which exhibit characteristics such as mobility or convertibility have a higher value than similar immobile or inconvertible factors. Here is another example: nominal wage rates mean little but real wage rates convey important information about wages since it is then put in terms that are relative to other prices. So even if all prices are decreasing but the wage rate is decreasing to a lesser degree then the real wage rate is actually increasing. The market is the vehicle for conveyance of this valuable information and people make decisions or choices based on it.

Business individuals active in the market assess costs and revenues and continually modify their plans due to the signals that come as a result of changes in demand and supply. These adjustments that are made as prices are influenced by demand and supply demonstrate that the price system is both dynamic and efficient.

Marginal Utility

Closely allied to relative prices is the concept of marginal utility. The market conveys information about the plethora of relative prices of goods and services but ultimately active decision-making by each person resides at the margin. The choice made is ultimately based on the subjective valuation about the perceived gain from the various choices.

Whichever choice is perceived to bring the greatest satisfaction and fulfillment at the margin is chosen. Let us assume that I am very hungry and that I can buy either a pencil or an apple for a quarter. I will readily recognize the greater marginal utility of the apple and buy it.

Imperfect Knowledge

This is an insurmountable and an inescapable reality! As imperfect knowledge is moderated by having some knowledge and having some

certainty people make decisions and act.

Part of the uncertainty comes from a lack of information, and the corollary to this is the uncertainty about the other human beings on the planet and their subjective decisions and their actions. The relatively free and immediate flow of knowledge that is the potential of the market ameliorates this condition. Another part of the uncertainty comes from the time element, that is, the great unknown we call the future. The only certainties are: that there are uncertainties, that the world is dynamic, and that the market works best when it is unhampered.

Profit and Loss

Concomitantly there is no certainty and therefore there is no guarantee that any effort made by a producer interacting in the market will yield

a profit. It is a simple fact that all exchanges that take place during the market process occur because of a double inequality of values. Will an exchange take place? Exchange occurs only when both parties value what they receive higher than what they give.

Involvement as an entrepreneur has risk because of uncertainty. The nature of the active entrepreneur is to be alert to opportunities, that is

to say, to needs not being met or not be being met as well as they could be. In the market it is possible that my perception as an entrepreneur is right or maybe it is wrong. It is possible that my perception of the resources that I happen to think are needed may combine to serve the consumer’s wants better; or perhaps not.

This is a part of the constant ebb and flow that necessarily results from the uncertainty in the real world. The market encompasses all of the various facets of the economy, such as: profit and loss, entrepreneurship,

communication, and knowledge; and the market conveys information in terms of relative prices.

In its earliest appearance in the primitive economy profit or loss was simply the outcome. If I raided a bird’s nest I either found food or not. If my effort was not productive my failed effort represented my loss. If my effort was productive the food then profited me. The profit motive is a necessary and inherent feature of the human operating system. As humans evolved and as the economy evolved profits enabled producers 1) to provide wages and other factor incomes, and 2) to be one of the sources of the capital that encourages endeavors with lengthier production times.

Economic Calculation

Implied in the word ‘calculation’ is a basis of knowledge. It is then from this basis of knowledge that the next step—that of calculation—can proceed. Implied in the word ‘economic’ is information about the economy, which ultimately then is disseminated via the market.

But first things first! It just so happens that private property is an even more preliminary part of the market than the actual diffusion of knowledge. Values, of course, are necessary for calculation. Material and ideal ‘things’ are valued and are therefore sought after to be ‘owned.’

This ‘value’ is the basis of knowledge for calculation.

The economy is dynamic and composed of many trillions of needs and decisions that often change complexion. The basis of knowledge needed for economic calculation comes from the market in the form of relative prices. These prices are relative to all other prices at the current moment.

The freer the market is the quicker the information can flow and the greater the ability is for it to correct errors. Desires, needs, and resources

converge in the market and find full expression in the form of relative prices. Economic calculation involves comparing and contrasting and speculating about the relative prices expressed through the market.

Any attempt to calculate economically using fictional non-market values—values arbitrarily assigned by someone removed from the market— ignores the dynamic nature of the knowledge within the market; which is tantamount to denying the human spirit. Use of non-market values is the reason why vertical production in an excessively large firm results in bureaucracy and calculation error, for instance.

This is also the reason why socialism fails, since it is an ‘error-based institution.’ What is meant by ‘error-based’ is the fact that the prices used for decision-making are arbitrary and imagined, not derived from the market process. These prices are erroneous and all decisions based on them are error-based.

Prices of Higher Order Goods

Not only does the market enable economic calculation but it extends beyond the here and now. The information in the market, the relative prices, also takes into account time. Goods which will reach the market in the future have a present value. And since they have value, so too, all of the resources needed in their production have value. In other words, factor prices also are relative prices.

However, without private property in factors of production there can be no realistic factor prices, and without factor prices cost accounting is impossible. To repeat, private property ownership is vital to the market. The economic calculation needed to realize profits, which pay the wages and factor incomes, depend on it. As decisions are made in the market—between consumer goods and higher order goods—a bridge forms between the present and the future. This bridging of the present and the future in the form of capital structure potentially leads to economic development.

Disutility of Labor

Exchange in the marketplace/market-process only happens if both parties feel that there is a gain. When an individual wishes to sell his services in the market he (she) checks to see what the relative prices (wages for example) are and then he must decide if the income is worth more than the alternatives, including leisure. What I mean by leisure is: whatever you would do instead of work if that was a choice that you could afford.

However, if leisure is subsidized in any way then less of the labor factor becomes available, which reduces the productive capacity of the economy and sends waves throughout the economy like ripples emanating from a pebble dropped in a pond. If leisure is subsidized then relative prices throughout the economy will change, leading to a cascading of aberrant decisions. Such is the plight and blight of the ‘welfare economy.’

There is nothing wrong with disutility of labor determining whether there is an exchange in the market as long as it is a true expression rather than one distorted by subsidies. There is nothing wrong with the disutility of labor; in fact, the disutility of labor is actually a motive force. It inspires alertness to choices and alternatives. Indeed, disutility of labor underlies entrepreneurship and it also underlies capital.

Competitive Theory

The natural tendency for humans is to make progress. That is what is implied in the act of exchange since exchange only takes place when both parties perceive a gain. This searching and questing and striving is part of the human operating system. That is not to say that there is not disorder in the economy, like the example just given about the disorder resulting from subsidizing leisure.

Making decisions at the margin, based on the relativities, and comparing where you are with where you want to be is natural and it is a human quality. Striving for excellence and refining oneself and one’s circumstances are meritorious expressions of this human trait. The knowledge that flows from the market-process provides the individual

with ‘data’ in the form of relativities. Judgment about what is available, what possibilities exist, and about one’s current condition, hinge on information available in the market.

Competition in the market is not a negative like it is in the animal world where ‘survival of the fittest’ is the outcome. The economy is divinely at the service of mankind. Competition in the market among producers leads to new and better goods and services and better means of production. With this advancing prosperity there are no long-run losers.

Currently, corruption of the divine economy by ego-driven manipulators directs wealth towards favored ones and away from others. This human intervention hampers the divine economy and is what causes ‘the rich to get richer and the poor to get poorer.’ In contrast to the hampered economy created by the interventionists, the net efficiencies that come from competition in a free market benefit everyone.

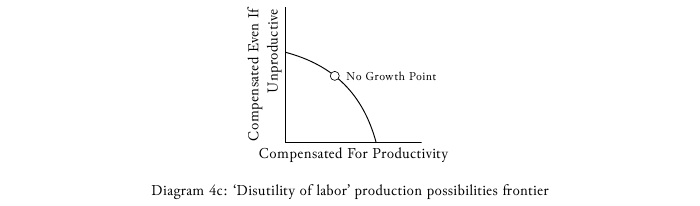

One of the eight economic principles – Disutility of Labor

Human Spirit / Order Quadrant Example—

Disutility of Labor

At a basic level each human being can distinguish between the ease or difficulty of the life task ahead. If a person is given the choice, that person will always prefer the easier of the two means of attaining their ends—as long as the task is not a recreational challenge or a personal development goal. What appears to be a non-productive urge—choosing the easy way—is actually a positive force.

Disutility of labor is a sign of intelligence. It is a motivating force that leads to innovation. It inevitably causes advancement and progress. Disutility of labor, despite being an underlying law of purposeful action, has been corrupted and turned into a negative characteristic in the economy under the current system of intervention. For instance, why work when your basic needs are met if you don’t work? Or, why provide excellent service when you get paid the same either way, plus you cannot lose your job? These distortions caused by interventions pervert the inherent power of this economic law that is an inherent part of purposeful human action.

Human Spirit / Order Quadrant PPF Example

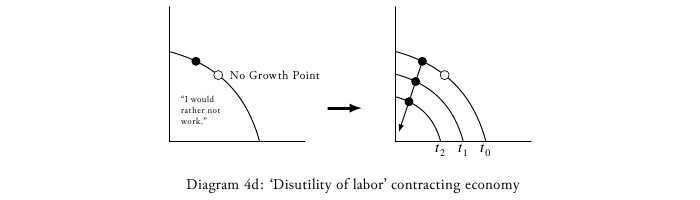

Developing production possibilities frontiers for each economic principle has never been done before! It requires contemplation and identification of the active principle and its antithesis. Let me take you through the thought process. A good place to start is to identify the meaning of the ‘no growth’ point. In this example—disutility of labor—the ‘no growth’ economy occurs when, in a relative sense, the aggregate satisfaction resulting from compensation for being nonproductive equals the satisfaction resulting from compensation for being productive. See Diagram 4c.

If in aggregate the lack of productivity is rewarded the economy will contract as shown in Diagram 4d. This is why ‘welfare economics’

is counterproductive.

For those who say that ‘welfare economics’ is compassionate the end result is far from compassionate. A contracting economy, which inevitably results from this type of economic intervention, offers less goods and services, less employment, and lower standards of living. All of this translates into increased human suffering so do not believe the ‘so-called compassionate’ ego-driven interventionists! See Diagram 4d.

Whereas this principle of the Human Spirit/Order Quadrant— disutility of labor as it occurs naturally in the divine economy—is an example of finding better ways to do things (Diagram 4e). Notably, it is where being productive is preferred over the tediousness of unproductive methods and habits.

Summary of the Human Spirit / Order Quadrant

The market is a time and place where information about relative prices is discovered. It is also a process within which knowledge flows. Not all knowledge is expressed as a price, but all knowledge is relative, and it is the market where such knowledge is accessible to humans.

The market can be described as unplanned order. It is economic action in the market that creates wealth. For the sake of human enlightenment and for the sake of human prosperity the market needs to be unhampered. Human intervention in the market is inevitably a corruption and a disruption of the divine economy.

Selected Exercises

⒈ Find and describe a real world example for one of the specific principles in the Human Spirit/Order Quadrant.

⒉ Develop a series of production possibilities graphs that show ‘no growth’ and ‘contracting’ and ‘expanding’ economies for one Human

Spirit/Order principle and describe the axes. Describe how the economy is affected if this economic principle is either understood or misunderstood.

Here’s the video recording of this session of the audiobook.

If you want to be notified at the time when the audiobook is Live on Facebook sign up here.

You can contact me if you have any questions.

You can check out all of the episodes by going to my YouTube channel.